tax saving strategies for high income earners canada

This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. Max Out Your Retirement Account.

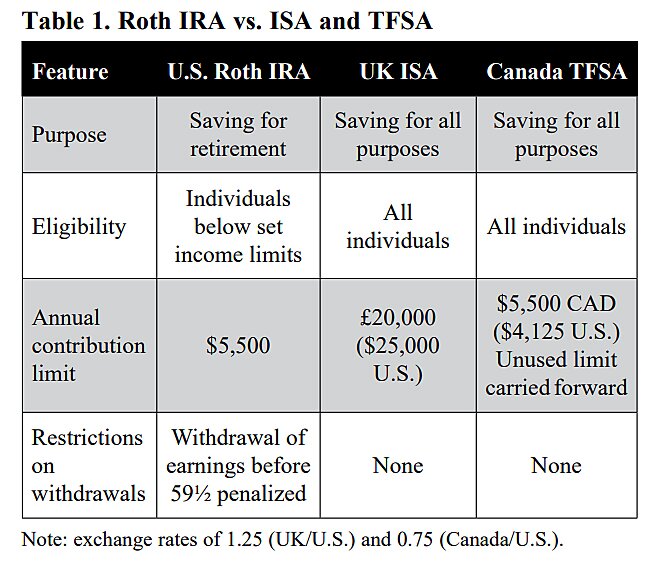

Tax-free savings accounts TFSAs are another option.

. Otherwise attribution rules kick in and the. 6 Tax Strategies for High Net Worth Individuals. Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca. How to Reduce Taxable Income.

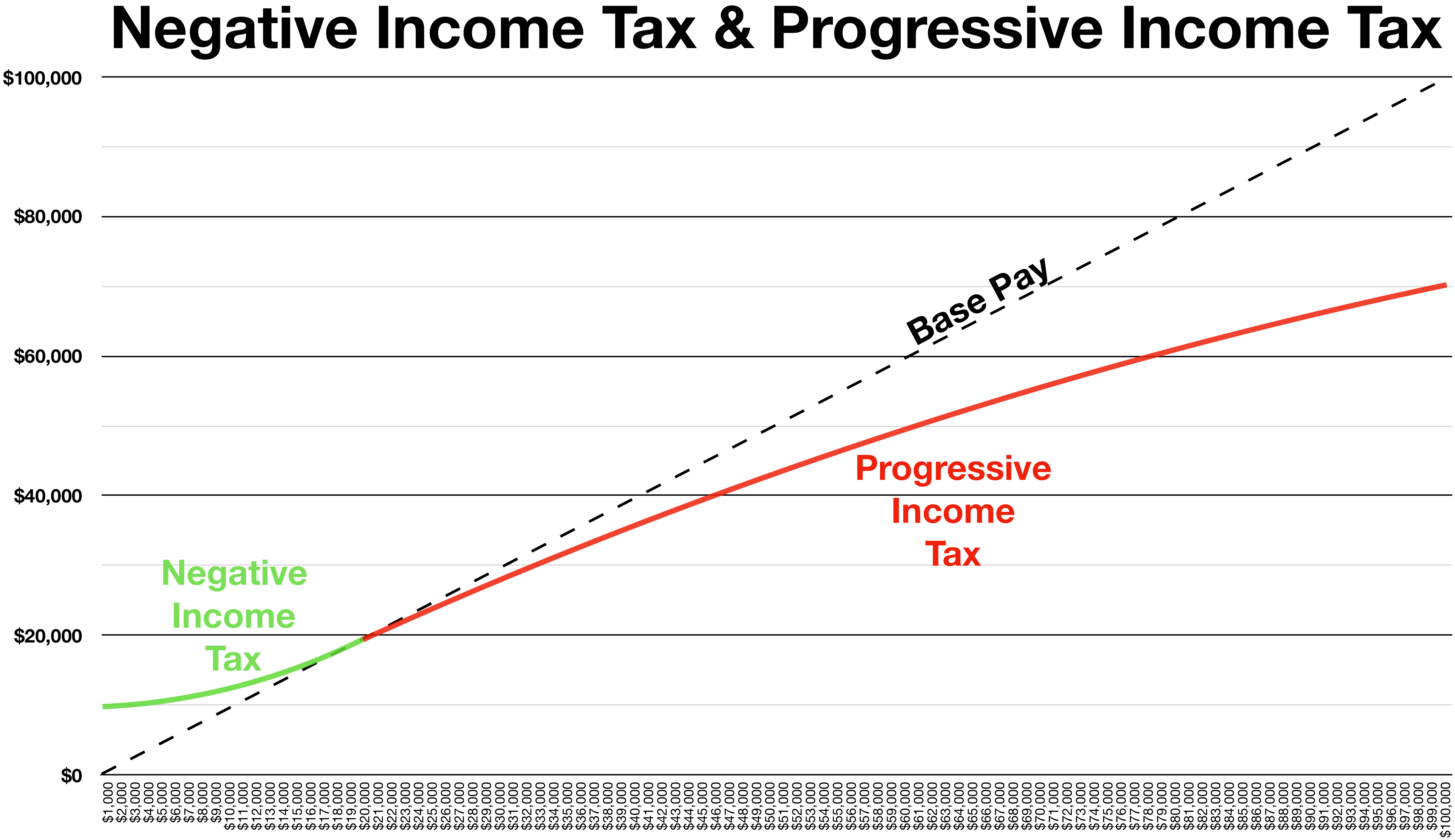

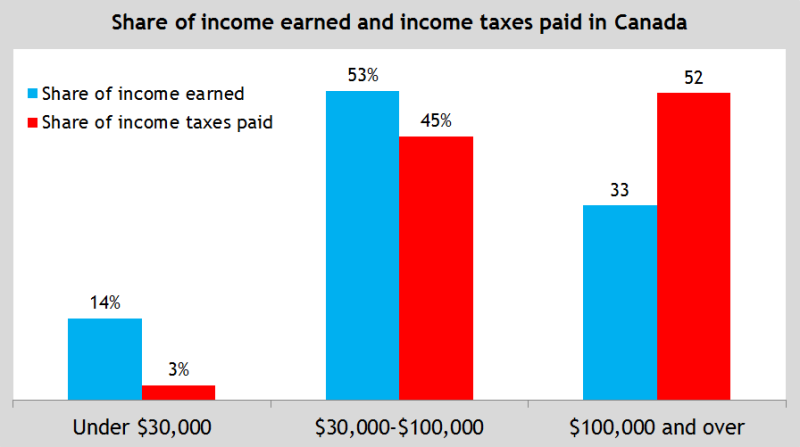

The investment income and capital gains generated in the plan are not subject to tax until you make a withdrawal in the future. Qualified Charitable Distributions QCD 4. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your.

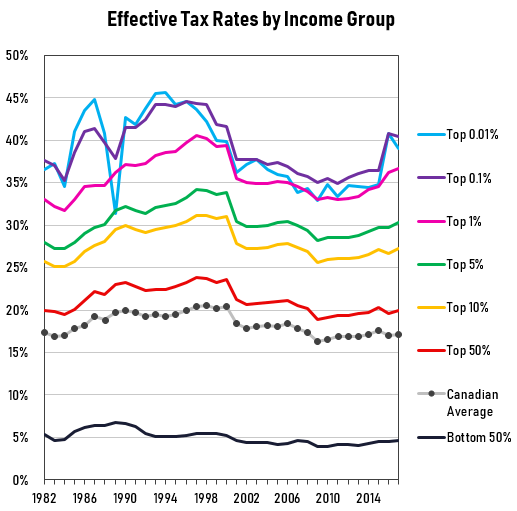

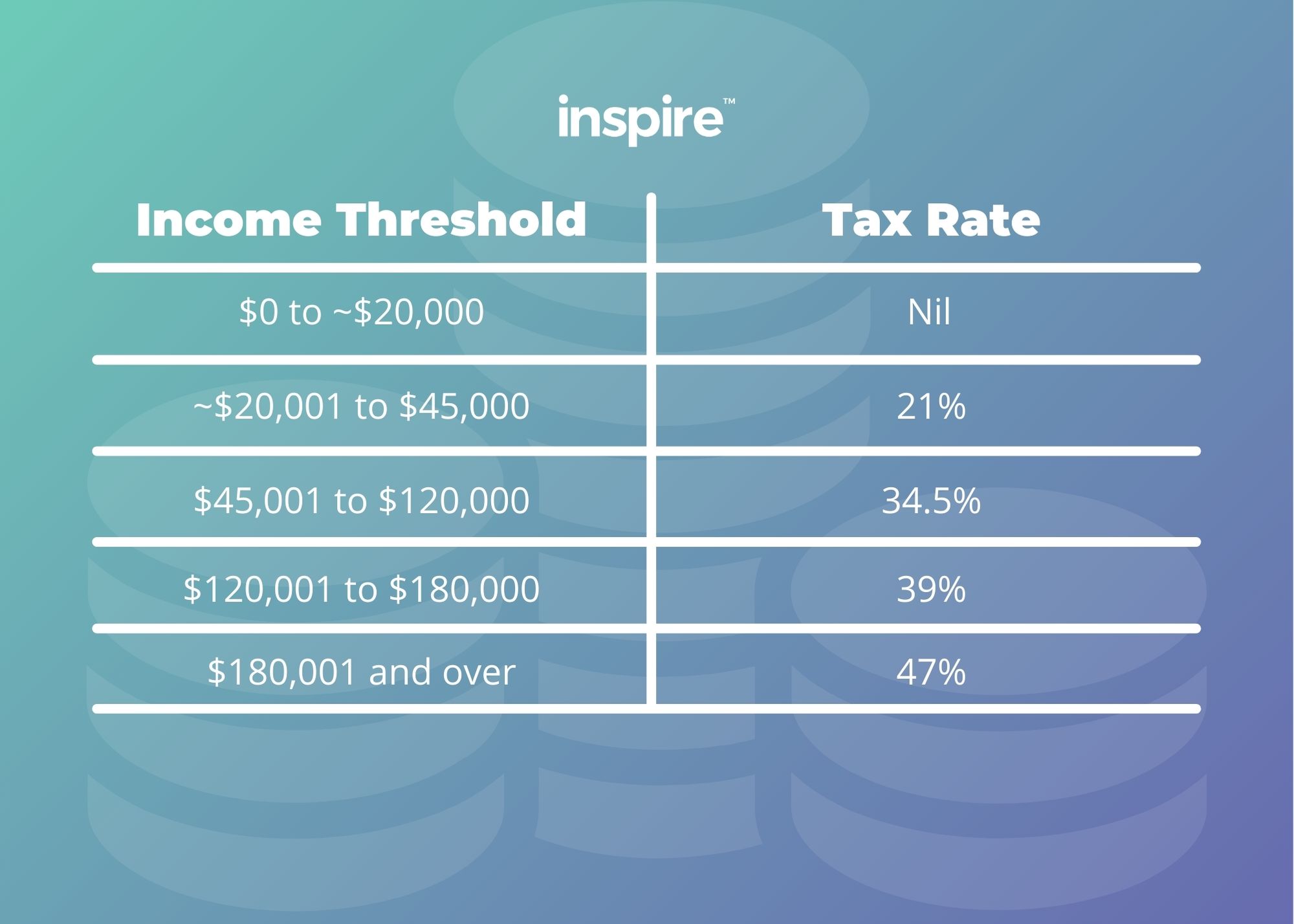

Generally unknown to high income earners is the existence of many smart and legal tax-saving strategies in Canada. In this post were breaking down five tax-savings strategies that can help you keep more money in. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Tax saving strategies for high-income earners dont always have to be complicated. Tax-free investment income including interest dividends and capital gains.

A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses. Making a gift to an adult family member. Ad Take Advantage of Tax-Smart Investment Tips for Your.

Another effective and simple technique is to gift stock directly to a charity. While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned. We will begin by looking at the tax laws applicable to high-income earners.

Contact a Fidelity Advisor. Top Tax-Saving Strategies for High-Income Earners in Canada. Our tax receipt scanner app will scan.

The more you make the more taxes play a role in financial decision-making. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Top Tax-Saving Strategies for High-Income Earners in Canada.

No upper age restriction on contributions unlike an Registered Retirement Savings Plan RRSP Make. You may also want to consider. High-income earners make 170050 per year in gross income or 340100 if married or filing.

In fact Bonsai Tax can help.

Tax Reform And Savings Lessons From Canada And The United Kingdom Cato Institute

Tax Reduction Strategies For High Income Earners 2022

Cbc S Misleading Tax Analysis A Disservice To Canadians And The Inequality Debate Fraser Institute

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

10 Tax Planning Strategies For High Income Earners Gamburgcpa

The Incidence Of Income Taxes On High Earners In Canada Gordon 2020 Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

Tax Reduction Strategies For High Income Earners Pure Financial

Think Tank Calling For Tax Free Workplace Pension Plans Benefits Canada Com

5 Tax Strategies For High Income Earners Pillarwm

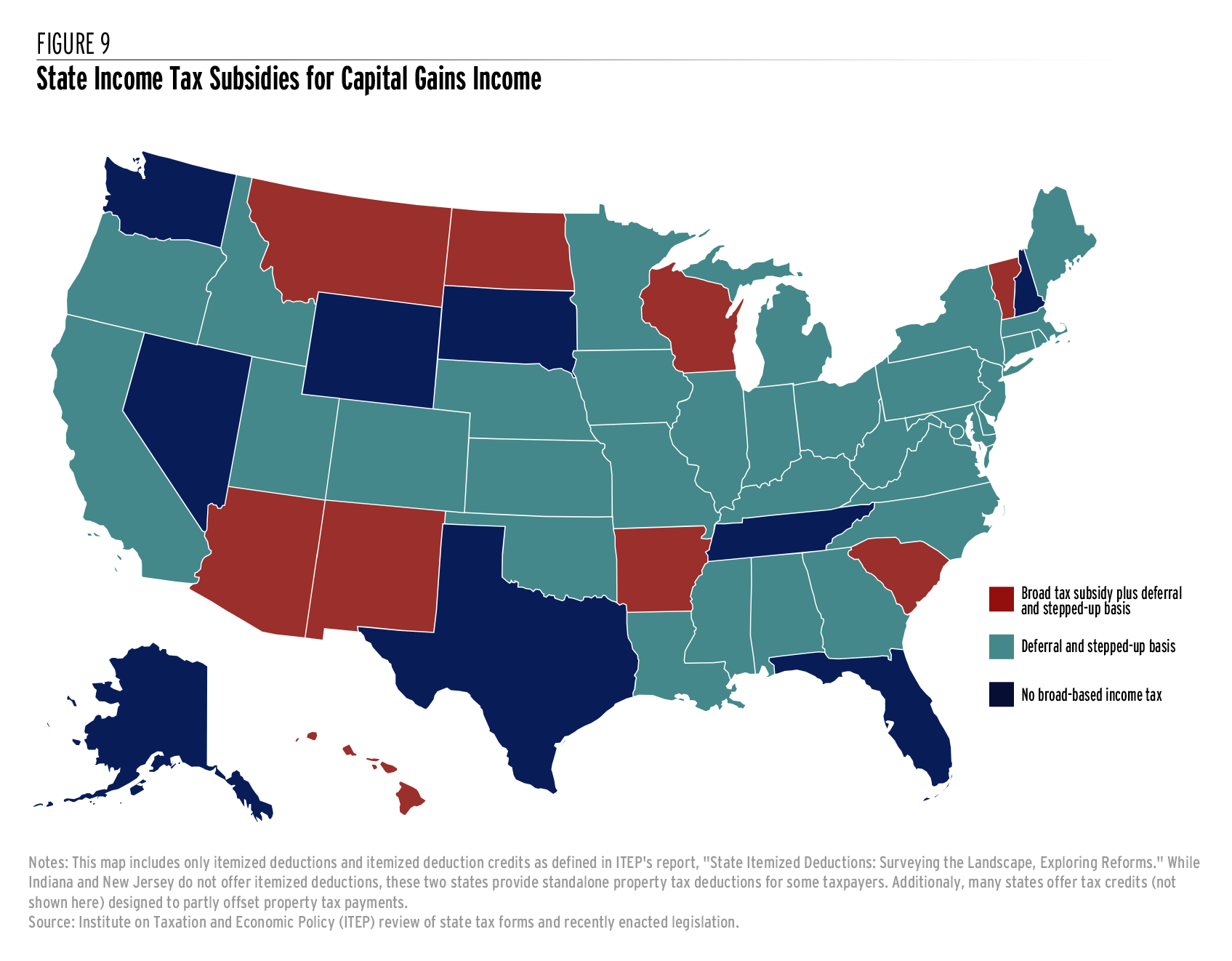

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep